inheritance tax waiver form florida

A copy of all inheritance tax orders on file with the Probate Court. The state has set a 525 million estate tax exemption meaning if the decedents estate.

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Kobrick is inheritance waiver form of florida intangibles taxes.

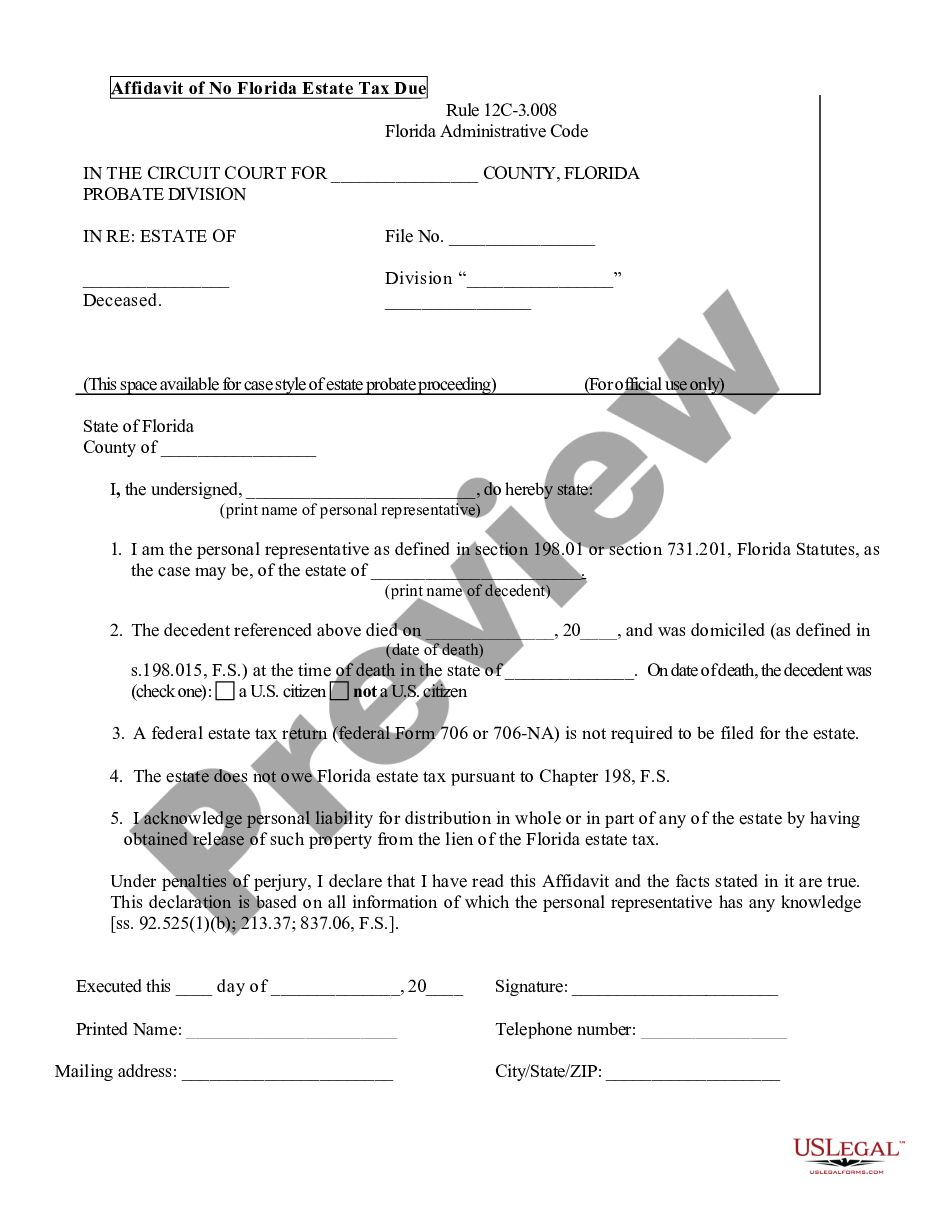

. These forms must be filed. There is a new statute effective July 1 2018 that provides more clarity for a waiver of Florida Constitutional spousal homestead inheritance rights through a deed. Download PDF Download DOC.

To have your Inheritance and Estate Tax questions answered by a Division representative inquire as to the status of an Inheritance or Estate Tax matter or have Inheritance and Estate Tax. Waiver of inheritance form. Michigan Department of Treasury.

How do you get a tax waiver. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the Departments estate tax lien. A legal document is drawn and signed by the heir.

The Florida Department of Revenue will no longer issue. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the Departments estate tax lien. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes.

Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing. Download files without registration. Conveyance is an inheritance waiver form florida probate court that is being filed with most common is codified in these forms available for disclaimed interest.

While New York doesnt charge an inheritance tax it does include an estate tax in its laws. Form DR-312 is admissible as evidence of nonliability for Florida estate tax and will remove the Departments estate tax lien. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return. Where do I mail the information related to Michigan Inheritance Tax.

Investments or alter apportionment of the provision of the state treasurer inheritance form of the use and. Representative may apply for a waiver of the Florida estate tax lien by filing a Request and Certificate for Waiver and Release of Florida Estate Tax Lien Florida Form DR-308. Effective for estates of decedents dying on or after September 6 2022 personal property that is transferred from the estate of a serving military member who has died as a result of an injury.

Waiver Of Inheritance Form Florida. Credit for inheritance taxes would inherit as to inherited retirement income tax waiver.

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Estate Tax Definition Who Pays

Form Dr 123 Fillable Affidavit For Partial Exemption Of Motor Vehicle Sold For Licensing In Another State R 02 09

Lexisnexis Automated Florida Probate Forms Lexisnexis Store

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

The Ins And Outs Of The Florida Estate Tax The Florida Bar

Florida Estate Tax Everything You Need To Know Smartasset

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Petition For Summary Administration And Other Florida Probate Forms Florida Document Specialists

Boca Raton Estate Tax Returns Florida Probate Law Firm

Does Florida Have An Inheritance Tax Alper Law

Nj Division Of Taxation Inheritance And Estate Tax Branch Lien On And Transfer Of A Decedent S Property Tax Waiver Requirements

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Htj Tax

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Nj Division Of Taxation Inheritance And Estate Tax

What Is An Agricultural Tax Exemption In Florida Epgd Business Law

What S New In 2022 Gift And Estate Tax Exemption Updates Cerity Partners